The markets finished the first half of the year in unprecedented territory. The S&P 500 is positive 15.29% year-to-date, the Nasdaq is positive 18.57% year-to-date and the Dow is positive 4.79%. The bond index is down 0.71%.

People used to say if the U.S. sneezes, the rest of the world catches a cold. The opposite can also be true. When it’s firing on all cylinders, the U.S. can help other export-oriented economies.

The U.S. economy will grow at a rate closer to 3.0% this year as consumers continue to spend, the labor market remains tight and manufacturers invest in newly diversified supply chains. Meanwhile, recession fears — widespread just a year ago — are no longer a given.

Most people would have thought that after the Federal Reserve raised interest rates as aggressively as they did, the U.S. would be in the middle of a recession right now. It is surprising that we haven’t seen more economic weakness. Fed Chair Jerome Powell has identified two paths to rate cuts: unexpected weakness in the labor market or inflation moving sustainably down to 2%. As Powell often states, Fed policy remains “data dependent.”

Elsewhere in the world, growth and inflation expectations are weaker than in the U.S., and central banks are expected to cut interest rates more rapidly. In contrast, India has emerged as a bright star in the emerging markets universe. India’s economy is expected to grow at a rate of 6.8% this year, according to IMF projections.

Elections are taking place throughout the world this year, but the rematch between Biden and Trump will be the most important. The result could produce a significant shift in political leadership, potentially triggering policy changes that could affect the investment environment, both in the U.S. and globally.

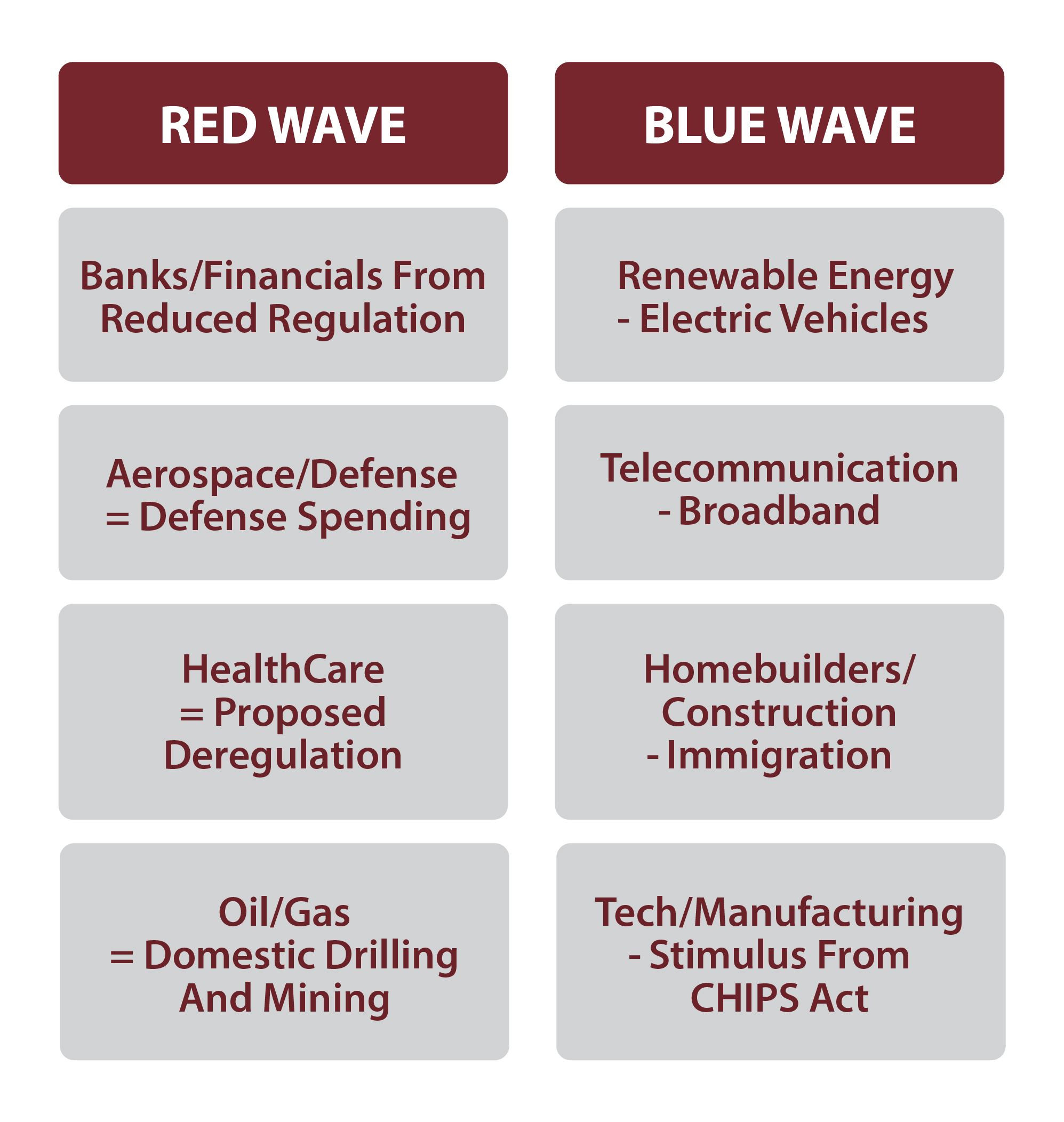

If one party controls — also known as a “Red Wave” or a “Blue Wave” — here are the potential beneficiaries:

The market tends to finish the year positive after the election, no matter which party wins. The market also tends to have positive returns in the second half of a year when the first half is above the 10% trend. Both tend to average around an 8% return in the back half of the year.

Most of what we see from folks like JP Morgan and Goldman Sachs is that they like the U.S. large caps because of our economic strength and European stocks because they are a bit undervalued and the economic trends are improving.

Check out my monthly MarketWatch blog at: http://wcmtexas.com/marketwatch

Have a question? Let me know! Email me at kcompton@wcmtexas.com.