In July, the indexes booked a fourth straight monthly gain, with the Dow gaining 2.4%, the S&P 500 advancing 5.5% and the NASDAQ rallying 6.8% for the month.

It occurs to me that folks tend to consider political figures as heroes or villains. That tendency sometimes leads to a lack of nuance, understating or ignoring the flaws of the heroes and the virtues of the villains. Although principles may be black and white, men and women are often gray especially when it comes to politicians. Take for example the offense of sexual harassment. An offense in which it appears both Trump and Biden are guilty. The Trump camp is quick to supply photos where Biden is over the line while completely ignoring or forgiving the same of Trump. Biden’s followers are no less blinded by their loyalty, pointing out comments where Trump appears to have admitted stepping over the line, while completely ignoring the same of Biden.

I am not trying to start a Trump/Biden debate here, I am merely pointing out that people’s tendencies lead to flawed thinking, which bleeds over into their investment decision making. According to certain folks, if Biden is elected we should put all our money into a jar under the mattress because he will most certainly kill the markets and any chance of a recovery. Other folks believe Trump is most certainly going to lead us into a Civil War 2.0.

The market thinks under a Trump Presidency and Republican Senate; we will see a repeat of 2016 – 2019 (excluding the pandemic). So let me explain what the market seems to be telling us about a Biden victory. In short, it will be a market neutral event, with some things hurting the investor sentiment while other policies help investor sentiment.

Biden says he will raise corporate income tax from 21% to 28%. In order to do that the Democrats must take the Senate. Even if it happens, that 7% delta will only affect a few companies, as most do not pay at the top of the bracket. Also, Biden probably won’t raise taxes in the middle of the Pandemic recession, so it seems unlikely we will see much tax change during the first year, should he win. Biden’s tax stance is considered market negative but not as negative as Obama. Balancing his tax policies are his trade policies which the market thinks will probably improve international trade. Biden is a traditionalist; he will probably look to end tariffs and try to align with allies and together apply group pressure. The market also seems to think Biden will provide less uncertainty because he is more predictable. Lastly, the market believes that there will be an infrastructure deal if the Senate flips to the Democrats. All in all, the market seems to be pricing in that a Biden Presidency would not be nearly as negative as the Trump camp wants you to believe.

The Federal Reserve’s policy response time to the COVID-19 crisis has been swift and aggressive. The Fed expanded its balance sheet by 84% within six months following February’s market peak, posting its highest balance of $7 trillion. In comparison, the Fed introduced asset purchases 11 months after the market peak during the 2008 global financial crisis, only expanding its balance sheet to a peak balance of $2 trillion. Back then, the fix was to fix the banks. This time around the fix is to fix the velocity of money. Needless to say, suppressed economic activity extending for months into the future is problematic and will likely push more and more companies over the edge and into bankruptcy. Already, many small businesses have closed and are not likely to reopen. According to the American Bankruptcy Institute, there were 560 commercial Chapter 11 filings in April, a 26% increase from last year. Some of the more high profile bankruptcies include J.C. Penney, Neiman Marcus, J. Crew and Hertz.

Temporarily offsetting the dramatic fall in economic activity is the continuing commitment of the Federal Reserve and Treasury to provide massive amounts of liquidity to consumers and businesses. Direct purchases by the Fed of a broad cross section of corporate debt have helped limit defaults and served to buoy high-yield corporate bond prices.

VOLATILITY

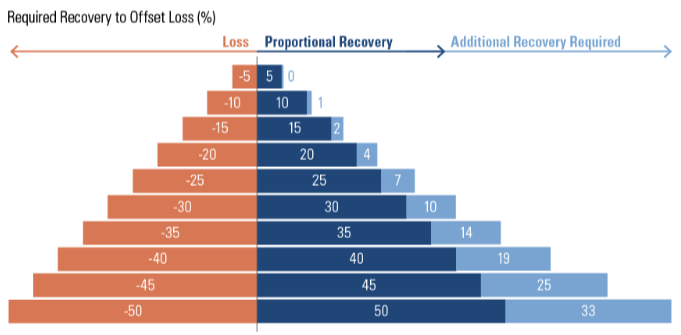

Given the multiplicity of factors elevating uncertainty in today’s environment, we are reminded that in order to fully recover a -35% loss, a portfolio must subsequently return +35% and then an additional +14%. The hurdle for recovery from large losses is high. While risk assets may still be attractive, portfolios assembled in a risk-aware manner may help to reduce volatility and narrow the recovery gap.

Source: Goldman Sachs Asset Management July 31, 2020

Check out my monthly MarketWatch blog at: https://wsmtexas.com/marketwatch/

Have a question? Let me know! Email me at kcompton@wsmtexas.com.