When working on your business or personal tax filings this year, don’t forget about the Affordable Care Act (ACA). The ACA has certain tax filing requirements both for individuals and businesses. Here’s a breakdown on what you need to know to be in compliance this year:

For individual taxpayers, you are now required to show proof that you have “minimal essential coverage.” You should receive this proof – Form 1095 – from your employer or insurer. If you bought your health insurance on the exchanges last year, you’ll get a 1095-A. You will need this form to complete Form 8962, which reconciles any advance payments of the premium tax credit or to claim the premium tax credit. Form 1095-B will be sent to you if you work for a small employer or bought insurance privately (like directly through BlueCross BlueShield). Form 1095-C should arrive if you work for an applicable large employer (50 or more employees).

Don’t worry if you don’t get a 1095-B or 1095-C by the time you file your 2015 tax return. Despite the requirement that these Forms be sent out, you don’t really have to do anything with the forms. In December, the IRS extended the deadline for employers to provide Form 1095-B and 1095-C to employees, from Jan. 31, 2016 to a new due date of March 31, 2016. So many taxpayers won’t get the forms before they file their taxes. Whether you self prepare your return or employ a tax professional it is important to have evidence that you actually have coverage. If you receive a W2 you may see the amount in box 12. Bottom line; you need to have coverage to a avoid penalty, but don’t fret about not having the Form 1095 in hand unless your coverage is through a Marketplace (exchange).

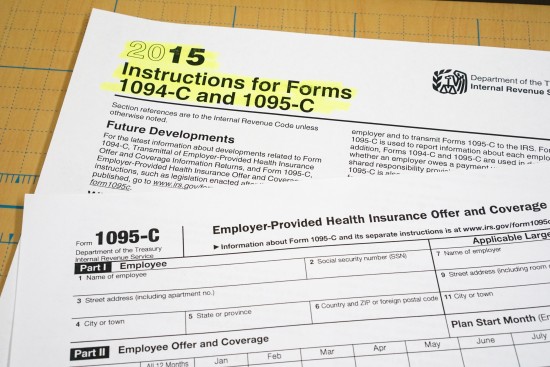

For business owners two new reporting requirements are now in effect for the 2015 tax year. First, the ACA now requires applicable large employers to provide an annual statement to each full-time employee detailing the employer’s health coverage offer. This is done by sending out the above referenced Form 1095-C. In addition, large employers now have another new IRS form; Form 1094-C. This is a transmittal form that applicable larger employers are required to send to the IRS by the end of May 2016 (June if filed electronically).

Failure to send these forms may subject employers to the general reporting penalty provision, therefore it is extremely important that business owners are diligent in determining if and who will be sending this form out. Our advice is to first check with your insurance provider, and in the event that they will not be sending the form out, check with your CPA or IRS website for guidance on how to complete the forms properly.

The new reporting requirements are intended to help the IRS administer several provisions under the Affordable Care Act. Specifically, to determine whether employees are eligible for subsidies, or should be subject to penalties for failure to obtain health insurance; or whether employers failed to offer affordable minimum value coverage to full-time employees.

In future years Form 1095s will be the reporting mechanism the IRS uses to verify if individuals have obtained health insurance coverage, and will be a required document for taxpayers to have when filing their tax return.